August 27, 2020

Will Fossil Fuel Divestment Usher in a New Era of Sustainable Growth?

By Melanie Mason

The fossil fuel divestment movement is gaining momentum as a large scale energy transition is underway. Over the past 5 years, major players have begun to divest from the fossil fuel industry and many financial analysts and environmentalists approve: not only is this the financially-savvy thing to do, it could play a major role in climate change mitigation and the shift to sustainable energy.

In 2011, passionate Swarthmore College students kicked off the very first

fossil fuel divestment campaign in the United States, urging Swarthmore’s endowment to divest from coal immediately, and from oil and gas within 5 years. In 2012, environmentalist Bill McKibben and

350.org launched the

Do the Math Tour, traveling around the world urging all institutions to divest from fossil fuels. In the years that followed, college students, activists, and environmental organizations held up bold signs, protested in the streets and on campuses, and spoke to huge audiences about the importance of the divestment movement.

The movement was gaining traction when an influential name in philanthropy made a big announcement. In 2014 the Rockefeller Brother’s Fund

announced they would fully divest from fossil fuels by 2017. Next, global financial institutions and the world’s financial capital, New York City, jumped on board. Many of the major moments in the divestment movement have come from well known institutions who influence public opinion, hurt the reputations of fossil fuel companies, and receive tons of press. Leaders were sending the message that carbon does not have a future.

A Divestment Timeline

2011 Swarthmore College students start the

first fossil fuel divestment campaign

2012 Environmentalist Bill McKibben and 350.org launched

Do the Math Tour

2014 The

Rockefeller Brother’s Fund announces divestment commitment

2018 Mayor De Blasio announces

plans to divest $5 Billion of NYC’s tension fund from the fossil fuel industry and files lawsuits against fives major oil companies.

2019

Goldman Sachs announces biggest fossil fuel divestment plan of any major US bank

2020:

Black Rock, the world’s largest asset manager, announces divestment from coal.

The University of California, one of the largest university systems in the country,

announces that its investment portfolios are fossil free after the sale of more than $1 billion in assets from its pension, endowment and working capital pools.

Doing Well by Doing Good

The movement started from a moral and ideological standpoint but the financial incentives alone are causing companies to take notice. While

critics expressed concerns over the effects it would have on pension funds and corporate profits, studies have shown that divesting from fossil fuels is a sound financial decision.

In May 2020, the Rockefeller Brother Fund released a 5 year

case study showing that divesting from fossil fuels increased returns when compared to the previous 5 years.

In July 2018, the Institute for Energy Economics and Financial Analysis released a

report showing that fossil fuel stocks that were once a safe and profitable investment are declining in value and considered risky. This is largely due to competition from hydraulic fracking and clean energy.

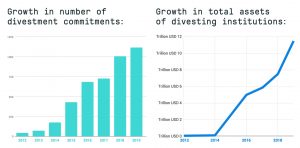

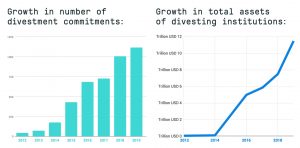

The graphs shown below are from a 350.org

report show a massive increase in divestment commitments and in total assets of institutions that divested from 2012 – 2019.

350.org Report on Divestment Commitments

Two Sides of the Coin

Environmental organizations are increasingly calling for divestment from fossil fuels AND investment in sustainable solutions. At the time of their divestiture announcement, the University of California had also surpassed their five-year goal of investing $1 billion in promising clean energy projects. Even fossil fuel companies are starting to get on board. Earlier this year, BP Oil

announced plans to make their operations carbon neutral by 2050, and included on their list of “aims to help the world get to net zero”an increase in the proportion of their investment into non-oil and gas businesses over time. With the global clean energy market

projected to grow from $928 Billion in 2017 to $1,512.3billion in 2025, there is clearly money to be made by doing the right thing for the planet.

It’s important to note that the divestment tactic alone is not enough to significantly decrease carbon emissions, but it can be a critical step. Not only does divestment move funds away from the fossil fuel industry and possibly toward renewables, it educates everyone on the importance of shifting to clean energy, and shapes public opinion, which in turn, can influence business decisions. While the big banks aren’t exactly taking an active part in the divestment movement, the news there is transparency.

Morgan Stanley,

Citi, and

Bank of America announced this year that they will measure and disclose emissions from their lending and investment portfolios. That might not turn things around immediately, but in McKibbens’s

own words, if we “make enough progress in our time…the next generation of people” will have a “reason to keep doing it.”

In 2011, passionate Swarthmore College students kicked off the very first fossil fuel divestment campaign in the United States, urging Swarthmore’s endowment to divest from coal immediately, and from oil and gas within 5 years. In 2012, environmentalist Bill McKibben and 350.org launched the Do the Math Tour, traveling around the world urging all institutions to divest from fossil fuels. In the years that followed, college students, activists, and environmental organizations held up bold signs, protested in the streets and on campuses, and spoke to huge audiences about the importance of the divestment movement.

The movement was gaining traction when an influential name in philanthropy made a big announcement. In 2014 the Rockefeller Brother’s Fund announced they would fully divest from fossil fuels by 2017. Next, global financial institutions and the world’s financial capital, New York City, jumped on board. Many of the major moments in the divestment movement have come from well known institutions who influence public opinion, hurt the reputations of fossil fuel companies, and receive tons of press. Leaders were sending the message that carbon does not have a future.

A Divestment Timeline

2011 Swarthmore College students start the first fossil fuel divestment campaign

2012 Environmentalist Bill McKibben and 350.org launched Do the Math Tour

2014 The Rockefeller Brother’s Fund announces divestment commitment

2018 Mayor De Blasio announces plans to divest $5 Billion of NYC’s tension fund from the fossil fuel industry and files lawsuits against fives major oil companies.

2019 Goldman Sachs announces biggest fossil fuel divestment plan of any major US bank

2020: Black Rock, the world’s largest asset manager, announces divestment from coal.

The University of California, one of the largest university systems in the country, announces that its investment portfolios are fossil free after the sale of more than $1 billion in assets from its pension, endowment and working capital pools.

Doing Well by Doing Good

The movement started from a moral and ideological standpoint but the financial incentives alone are causing companies to take notice. While critics expressed concerns over the effects it would have on pension funds and corporate profits, studies have shown that divesting from fossil fuels is a sound financial decision.

In May 2020, the Rockefeller Brother Fund released a 5 year case study showing that divesting from fossil fuels increased returns when compared to the previous 5 years.

In July 2018, the Institute for Energy Economics and Financial Analysis released a report showing that fossil fuel stocks that were once a safe and profitable investment are declining in value and considered risky. This is largely due to competition from hydraulic fracking and clean energy.

The graphs shown below are from a 350.org report show a massive increase in divestment commitments and in total assets of institutions that divested from 2012 – 2019.

350.org Report on Divestment Commitments

In 2011, passionate Swarthmore College students kicked off the very first fossil fuel divestment campaign in the United States, urging Swarthmore’s endowment to divest from coal immediately, and from oil and gas within 5 years. In 2012, environmentalist Bill McKibben and 350.org launched the Do the Math Tour, traveling around the world urging all institutions to divest from fossil fuels. In the years that followed, college students, activists, and environmental organizations held up bold signs, protested in the streets and on campuses, and spoke to huge audiences about the importance of the divestment movement.

The movement was gaining traction when an influential name in philanthropy made a big announcement. In 2014 the Rockefeller Brother’s Fund announced they would fully divest from fossil fuels by 2017. Next, global financial institutions and the world’s financial capital, New York City, jumped on board. Many of the major moments in the divestment movement have come from well known institutions who influence public opinion, hurt the reputations of fossil fuel companies, and receive tons of press. Leaders were sending the message that carbon does not have a future.

A Divestment Timeline

2011 Swarthmore College students start the first fossil fuel divestment campaign

2012 Environmentalist Bill McKibben and 350.org launched Do the Math Tour

2014 The Rockefeller Brother’s Fund announces divestment commitment

2018 Mayor De Blasio announces plans to divest $5 Billion of NYC’s tension fund from the fossil fuel industry and files lawsuits against fives major oil companies.

2019 Goldman Sachs announces biggest fossil fuel divestment plan of any major US bank

2020: Black Rock, the world’s largest asset manager, announces divestment from coal.

The University of California, one of the largest university systems in the country, announces that its investment portfolios are fossil free after the sale of more than $1 billion in assets from its pension, endowment and working capital pools.

Doing Well by Doing Good

The movement started from a moral and ideological standpoint but the financial incentives alone are causing companies to take notice. While critics expressed concerns over the effects it would have on pension funds and corporate profits, studies have shown that divesting from fossil fuels is a sound financial decision.

In May 2020, the Rockefeller Brother Fund released a 5 year case study showing that divesting from fossil fuels increased returns when compared to the previous 5 years.

In July 2018, the Institute for Energy Economics and Financial Analysis released a report showing that fossil fuel stocks that were once a safe and profitable investment are declining in value and considered risky. This is largely due to competition from hydraulic fracking and clean energy.

The graphs shown below are from a 350.org report show a massive increase in divestment commitments and in total assets of institutions that divested from 2012 – 2019.

350.org Report on Divestment Commitments

Two Sides of the Coin

Environmental organizations are increasingly calling for divestment from fossil fuels AND investment in sustainable solutions. At the time of their divestiture announcement, the University of California had also surpassed their five-year goal of investing $1 billion in promising clean energy projects. Even fossil fuel companies are starting to get on board. Earlier this year, BP Oil announced plans to make their operations carbon neutral by 2050, and included on their list of “aims to help the world get to net zero”an increase in the proportion of their investment into non-oil and gas businesses over time. With the global clean energy market projected to grow from $928 Billion in 2017 to $1,512.3billion in 2025, there is clearly money to be made by doing the right thing for the planet.

It’s important to note that the divestment tactic alone is not enough to significantly decrease carbon emissions, but it can be a critical step. Not only does divestment move funds away from the fossil fuel industry and possibly toward renewables, it educates everyone on the importance of shifting to clean energy, and shapes public opinion, which in turn, can influence business decisions. While the big banks aren’t exactly taking an active part in the divestment movement, the news there is transparency. Morgan Stanley, Citi, and Bank of America announced this year that they will measure and disclose emissions from their lending and investment portfolios. That might not turn things around immediately, but in McKibbens’s own words, if we “make enough progress in our time…the next generation of people” will have a “reason to keep doing it.”

Two Sides of the Coin

Environmental organizations are increasingly calling for divestment from fossil fuels AND investment in sustainable solutions. At the time of their divestiture announcement, the University of California had also surpassed their five-year goal of investing $1 billion in promising clean energy projects. Even fossil fuel companies are starting to get on board. Earlier this year, BP Oil announced plans to make their operations carbon neutral by 2050, and included on their list of “aims to help the world get to net zero”an increase in the proportion of their investment into non-oil and gas businesses over time. With the global clean energy market projected to grow from $928 Billion in 2017 to $1,512.3billion in 2025, there is clearly money to be made by doing the right thing for the planet.

It’s important to note that the divestment tactic alone is not enough to significantly decrease carbon emissions, but it can be a critical step. Not only does divestment move funds away from the fossil fuel industry and possibly toward renewables, it educates everyone on the importance of shifting to clean energy, and shapes public opinion, which in turn, can influence business decisions. While the big banks aren’t exactly taking an active part in the divestment movement, the news there is transparency. Morgan Stanley, Citi, and Bank of America announced this year that they will measure and disclose emissions from their lending and investment portfolios. That might not turn things around immediately, but in McKibbens’s own words, if we “make enough progress in our time…the next generation of people” will have a “reason to keep doing it.”