December 14, 2008

Here are three questions from a student at Rutgers who was working on a paper about the costs, benefits, and barriers of retrofitting affordable housing to improve energy efficiency:

Are the tenants of green affordable homes seeing true savings?

Are they increasing awareness about other environmental issues to communities that normally wouldn’t?

How are policies creating incentives for developers to build green when the savings goes mostly to the tenants?

These are good questions and ones that are difficult to get definitive (or in my case, short) answers.

Are the tenants of green affordable homes seeing true savings?

In NYC, tenants pay only their cooking fuel and electricity. Landlords are required to provide heat/hot water and pay the water/sewer charges. This means that the only in-unit retrofits impact tenant utility bills.

All things being equal, if a landlord retrofits an apartment with energy-efficient fixtures and appliances, tenants should see savings on their electric bills. Electricity use in an apartment depends on several

things that the landlord can control — the efficiency of the lighting *FIXTURE* installed; fridge, and any other appliance installed by the landlord; the kitchen/bath fixtures. Whether the retrofits result in

savings or not depends not only on the efficiency of the equipment installed, but also on the possibility of altering user behavior (in either direction — to save or to waste).

In-unit Light Fixtures: I say fixtures specifically because one way of addressing in-unit lighting is to gift or subsidize screw-in CFLs — this is, in my opinion, less effective _in impacting the energy consumption_ because tenants can choose to discard them (especially if they didn’t buy them to begin with) and replace them with at regular-old 35-cent incandescent bulb. Giving out CFLs is perhaps useful as a way of creating an educational opportunity around energy efficiency, but perhaps not a watertight way of getting lower electric usage.

Appliances: I see no reason why putting in an energy efficient appliance would cause a person to hold open the fridge door for longer. If you put in efficient appliances, you’re going to see some reduction in the energy use.

Kitchen/bath fixtures impact energy use (generally speaking) in two ways: first, if there’s something pumping water around, and that pump uses energy; second, it takes energy to heat water, so if you reduce your use of hot water, you reduce the amount of energy need to do the heating. Again, if you (the landlord) install a flow regulator that can be removed, and the low-flow fixture results in a perceived decline in comfort, then the rational thing for the tenant to do would be to remove the flow regulator.

Here’s where the “all things being equal” comes into play. The word on the street (I’m not an engineer so don’t quote me) is that electric use varies a lot more than say, heating fuel use. This is partly because it depends a lot more on individual preferences — one person might have every plug in the house attached to 6 gadgets whereas someone else might be living a monkish life of electric appliance abstinence. One would imagine, though, that this kind of variation should be white noise that you can tease out in statistical analysis, if the fact of lower bills doesn’t then induce demand (eg. Lower bills = more money for me to buy gadgets -> higher usage next month).

The other “all things being equal” factor is the price of electricity. If your energy use declines, but prices rise faster than your use declines, then you won’t end up with lower bills. According to the EIA, electric prices ought to level off and decline a little in the next several years. In NYC, however, that’s not the story: rates are expected to rise over time as the utilities deal with various capital improvements that have been held up over the years. On the other hand, there’s an argument to be made that you’re still better off with more energy efficient equipment because your bills would have been even higher with the old, inefficient stuff.

Are they increasing awareness about other environmental issues to communities that normally wouldn’t?

That would be a fantastic masters thesis topic, especially if you design a study instrument that attempts to tie “awareness” to some externally observable happening. Eg. Are recycling rates higher in green buildings versus regular buildings? Are the tenants living in green buildings more likely to say they will vote on environmental issues than voters in the general population? I don’t know what other proxies you could use for “aware”.

How are policies creating incentives for developers to build green when the savings goes mostly to the tenants?

So, let me tease out two questions from your one:

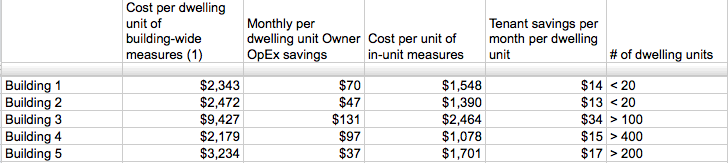

Do savings go mostly to the tenants? If you’re talking about a commercial net lease, then yes, there’s a giant split incentive. In NYC multifamily buildings, however, it’s not as bad as all that. As you can see in the chart below, the owner derives a lot more savings than the tenant on a per dwelling unit per month basis. And this is for projects where they plan to go in and replace lights and appliances and all that, not just hand out light bulbs. Consider also, that $14 savings per tenant isn’t all that much to the tenant, but whatever the owner saves per unit is multiplied by the number of units, and that turns out to be a chunkier dollar figure.

Costs and savings proposals for 5 NYC buildings

At the moment, it’s done with a stick. If you want to tap NY State incentives, you have to include some in-unit measures. What is more interesting, in the case of affordable housing, is the possibility of using a different amount for the utility allowance. The short version of the story: The cost of living in a home is the rent you pay plus utilities and any other services for the unit (eg. If you have to provide your own fridge, the cost of the fridge etc). Rent regulations basically put a cap on the total cost of living in a home, with an estimated “utility allowance” plus rent being what has to stay under the bar. IRS recently revised the rules about how you can calculate the rent allowance, allowing owners who make in-unit improvements reduce the utility allowance in the rent calculation, effectively keeping the total cost constant, but making rent a bit higher and utilities a bit lower. This means that the owner can make back some the investment in the unit by collecting a piece of the savings that would go to the tenant. A more direct version of this would be on-bill financing, but that’s a whole ‘nother email.

Hope that helps!

-Bomee